CATV

Even if there have been various significant technical advances in hybrid fiber-coax (HFC) architectures, it is pretty obvious that cable MSO are moving to put more fiber lines all the way over their plants and place fibers closer to subscribers. That’s largely because fiber is the chief enabler of most of the technological, financial, operational, and competitive gains operators are seeking to make. No matter whether they are aiming to go all-fiber, pursue a fiber deep strategy, or simply split more fiber-optical nodes, operators are reinforcing their existing infrastructure with more and more fiber. They aim to offer faster broadband speeds, save operational costs, deliver advanced video services like UHD/4K TV, boost up bandwidth capacity, support new wireless offerings such as 5G, improve service reliability, and perhaps most importantly, enhance their competitive positioning against other service providers.

As operators prepare for a new decade of competition with Telcos and other rivals by investing heavily in fiber, there are actually many questions about how cable MSOs intends to take advantage of their increased fiber save works. While several major MSOs have discussed their general fiber plans, the industry has not settled on an overall fiber build-out strategy. Nor have cable operators revealed much about how they will carry out their ambitious build-out agendas in tandem with other key network initiatives. Examples include the adoption of 10G-enabling technologies like Full Duplex DOCSIS, Extended Spectrum DOCSIS, and next-gen passive optical network (PON); the shift to distributed access architecture (DAA); the virtualization of network functions; and the roll-out of 5G wireless and small cells. Nor has there been much discussion about the challenges that face up with operators as they attempt to layout, test, and monitor their new fiber links.

Technical choices and migrations to enable 10G of Internet Speed

- Full Duplex DOCSIS

- Extended Spectrum DOCSIS

- RFoG (Radio Frequency over Glass)

- PON (Passive Optical Network)

- DAA (Distributed Access Architecture)

- Fiber Deep

- CIN (Converged Interconnect Network)

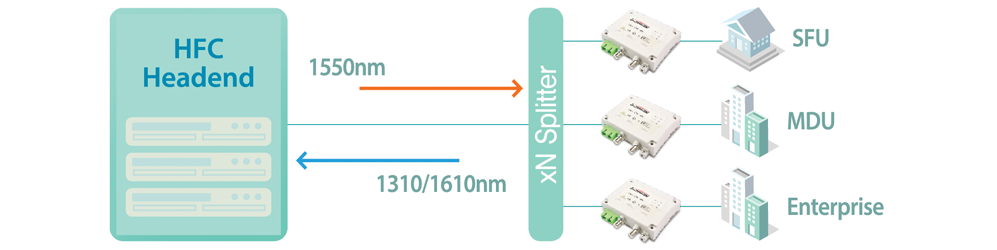

According to CATV industry outlook survey report by Light Reading, RFoG is the third choice of cable MSO with 21% share, followed by 10G-EPON (46%) and XGS-PON (22%). One of LIGHTRON’s exceptional competences is RF-Modulated analog optics design capability. LIGHTRON paved the way for RFoG market takeoff since 2007 and we are still shipping several flavors of Micro Nodes to the market. Our RFoG portfolio supports both NA/EU frequencies and D3.0/D3.1 bandwidth. RFoG network is also interconnected with different PON technologies. LIGHTRON WDM pass-thru nodes support all PON wavelength pass-thru capability and performances.

Fig.1 Common RFoG Architecture

Fig.1 Common RFoG Architecture

| Standard SFU & MDU | 1310/1550, 1610/1550, RF Power 18dBmV/ch (SFU), 36dBmV/ch(MDU) |

| Lambda Sweeper TM | 1610/1550, OBI Control with Tunable Operation. |

| WDM Micro Node | Any PON Wavelength Pass-thru (1270/1310/1490 & 1577nm) |

HFC Network Enhancement

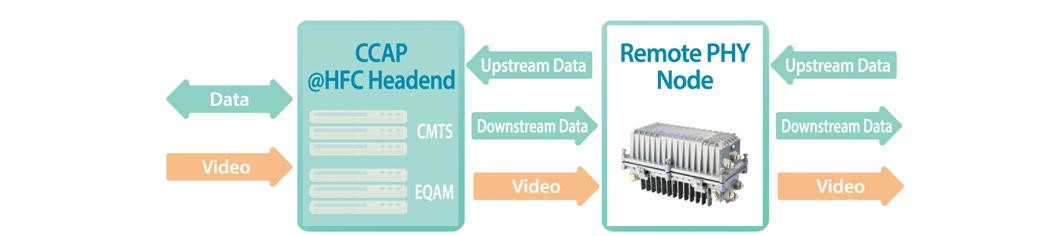

MSOs have been engaged with several architectural and technical strategies and will rely on a greater use of fibers. Access network edge will keep evolving to provide increased bandwidth, new services, improved customer experiences, maximum fiber utilization, reduced power and space and automated operational efficiencies. Distributed Access Architecture (DAA) provides functions that usually reside in the headend or hub distributed closer to subscribers. Moving functions into the network reduces the amount of hardware the headend (hub) needs to house, therefore efficiencies in speed, reliability, latency and security to uphold the support of 10G are created. RPD (Remote PHY) best identifies how DAA is implemented in access network edge of HFC plant areas. LIGHTRON introduces a bunch of hardened 10G DWDM SFP+ product family for Remote PHY nodes.

Fig. 2. Where Remote PHY is placed in HFC Plant?

Fig. 2. Where Remote PHY is placed in HFC Plant?

| 10G C-band Fixed DWDM | 10G BASE-ER & ZR, 22dB link budget, Operation Temp -40 ~ +92°C |

| 10G C-band Tunable DWDM | 10G BASE-ER & ZR, 22dB link budget, Operation Temp -40 ~ +92°C |